While heavy consumer borrowing remains a significant concern in the UK, Brits appear to have reigned in their spending against the backdrop of an increasingly volatile economic climate.

In fact, the recent boom in consumer borrowing has slumped to its lowest annual growth rate in four years. According to the Bank of England, annual consumer credit growth slowed to 6.6% in December, continuing a trend that had ran throughout the final quarter of 2018.

People who are already heavily indebted may also turn to debt consolidation as a way of improving their financial situation in the future. But what exactly is this, and can debt consolidation actively improve your credit score?

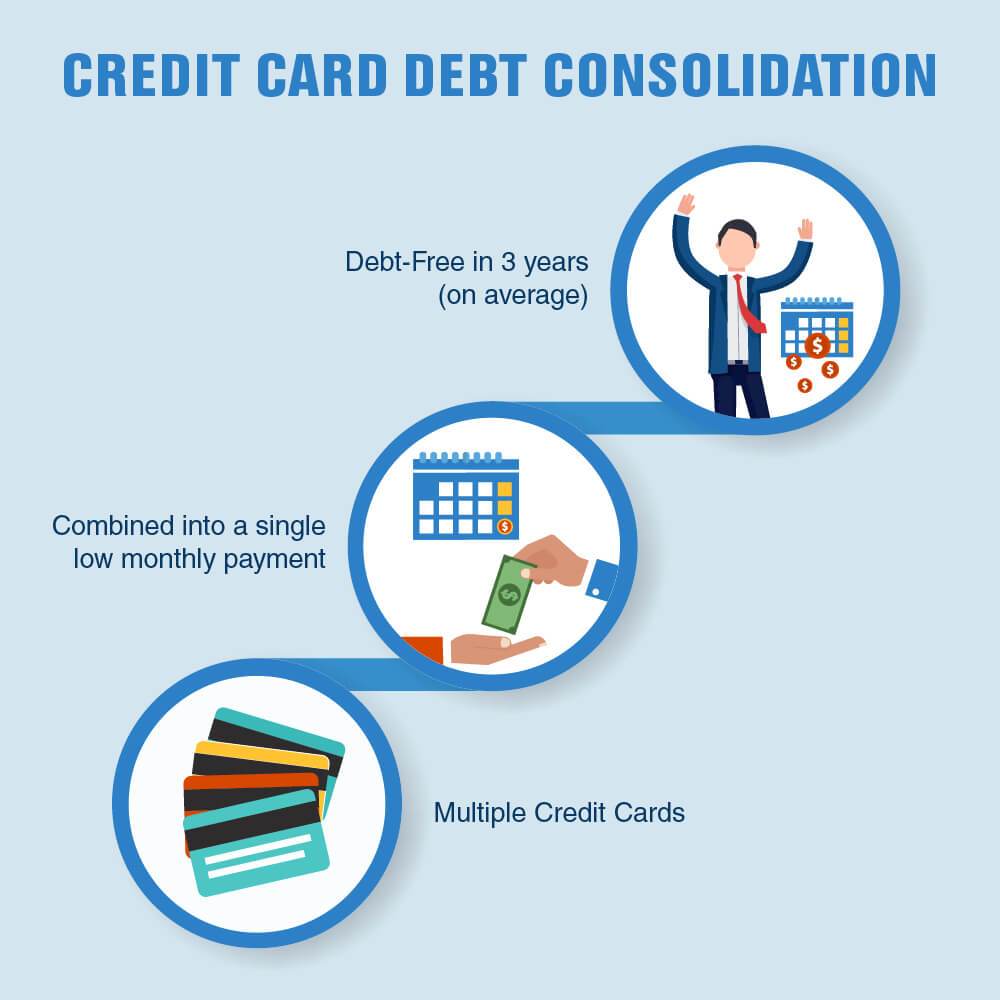

What is Debt Consolidation and What are its Benefits?

In simple terms, debt consolidation is a form of refinancing that requires you to create a single loan to pay off some or all your existing credit accounts.

When you liaise with a new lender or debt consolidation specialist, you’ll borrow a fixed amount according to your precise needs and financial circumstances. This will then be used to settle as much of your outstanding debt as possible, as you commit to a single monthly repayment to pay off the new liability.

The benefits of debt consolidation are clear; and this certainly makes sense for people who are struggling to manage multiple debts and make recurring repayments on time.

After all, a debt consolidation loan will require you to make a single repayment each month, making it easier to keep track of your finances and reduce your liability over time.

By committing to a single consolidation loan and monthly repayment, you can also reduce the amount of interest that you pay over time. This is important, as it means that you can spend more of your money on actively reducing debt rather than simply attempting to minimise the impact of interest rates.

Can Debt Consolidation Actively Improve your Credit Score?

The question that remains, of course, is whether debt consolidation can actively improve your credit score?

Much will depend on your ability to keep pace with your new repayment schedule, but if you can achieve this, you’ll quickly settle several outstanding debts while also adding some positive transactions to your credit score. On a similar note, debt consolidation may also settle outstanding credit card accounts and return these to a zero balance. But, while you should limit the amount of open accounts, you can also keep one of your credit card accounts open to make small monthly payments and create positive transactions on your report. Just try to stick to a low-limit credit card where possible, while also committing to settling your bill in full every month.